Anthology Together Conference Notes 2025

If only there was a time machine

Was this forwarded to you by a friend? Sign up, and get your own copy of the news that matters sent to your inbox every week. Sign up for the On EdTech newsletter. Interested in additional analysis? Try with our 30-day free trial and Upgrade to the On EdTech+ newsletter.

In my post ahead of the Anthology Together (and Blackboard) users conference, I noted the issues I was tracking.

Blackboard has significantly improved its pace of product development over the past few years, and while its Learn LMS might not be beating Canvas and Brightspace for intuitive interface, it is no longer “dated”.

Blackboard’s AI strategy is the most aggressive and public of any of the LMS vendors. That may or may not work long term and is an expensive bet they are making, but there is no problem with AI visibility.

What is missing is actually Anthology and Blackboard’s core problem - its corporate debt. The company has to restructure its debt (possibly including the use of bankruptcy or by breaking up the company), and the resolution of this problem is not in place yet. Or at least it is not public.

Now that I’ve been to the conference, I feel even stronger about these three observations, with the first two in opposition to the third. If only the company wasn’t facing a serious debt restructuring challenge.

Let’s start with the positive news then get to the problematic news.

Anthology Products

I am going to focus mostly on the LMS product line, but this cannot be completely separated from Anthology’s SIS and CRM and Data Analytics offerings. Which is Anthology’s central thesis, hence Anthology Together.

In the LMS world in particular, the conference was dominated by the integration of generative AI into the product line. And in a nutshell, Anthology’s lead in AI investments is paying off at the customer level. Other LMS vendors are introducing new features and new concepts that might make sense, but Anthology is at a point where customers are using the AI tools, and I heard from them directly.

For example, the Kentucky Community & Technical College System (KCTCS) is one of the largest and best Blackboard customers, and they are not just remaining on Blackboard, they are expanding usage in a way that highlights what Anthology’s product news is about.

What KCTCS folks told me at the show was that the rubric creation tool was the most useful AI feature from Blackboard, and it was materially saving instructor time on course design and providing better feedback to students.

Anthology announced a further integration of Blackboard and Reach (the CRM) that gives “faculty and advisors a unified view of student alerts and a powerful new way to take action together.” Basically, this integration better enables course activity seen in the LMS made available to advisors in the CRM, allowing a more proactive student support approach. KCTCS is adding Reach, largely based on this vision.

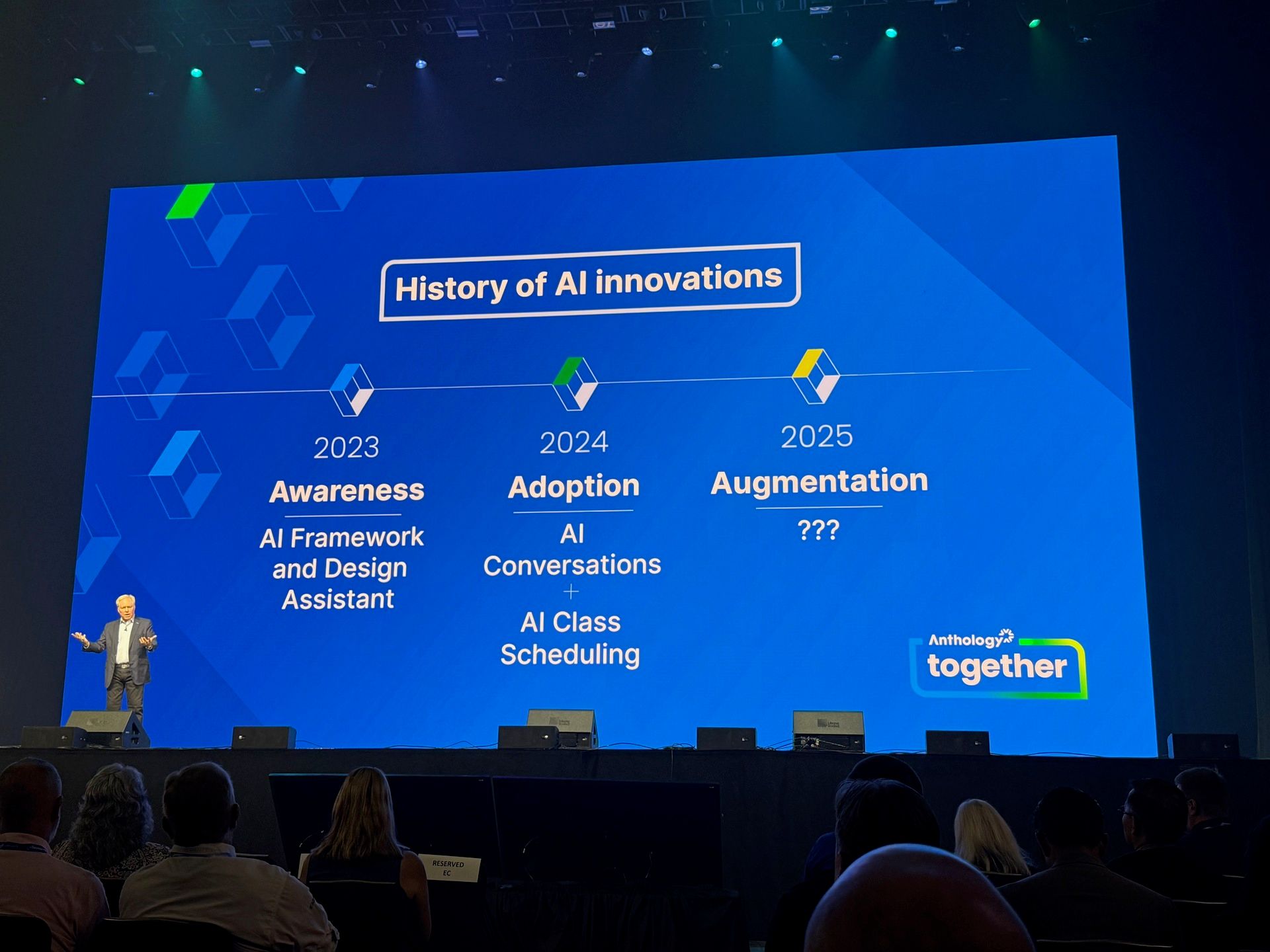

This feedback from customers aligned with Anthology’s messaging that 2023 introduced AI tools such as the course design assistant, but 2024 was about customer adoption and expanding of capabilities.

Beyond adoption of existing tools, Anthology announced the Anthology Virtual Assistant (AVA), which is a chat-based agent that provides a set of tools extending AI beyond specific buttons. AVA Automations (personalized nudges for students designed by instructors), AVA Responses (Q&A tool for student usage based on the course content and syllabus), AVA Feedback Assistant (content creation tools that instructors can use to give feedback to students), and AVA Playground (a sandbox to give equitable access to AI tools for students to explore).

The AI Design Assistant for Documents is also worth watching in terms of making it easier for faculty to revise and create documents, including the ability to remediate accessibility issues in static PDFs, for example.

This emerging LMS + CRM story is also significant, at least on paper and at a few institutions. Colleges and universities face existential challenges that are (or should be) emphasizing the importance of student success. I am on the record as questioning the LMS + SIS story, but the CRM one is different. Will more customers be willing to view these two products as a combination from one vendor? I do not know, but it makes sense.

And in other non-AI product news, there is increasing adoption of Video Studio and its ability to enhance faculty-student assignments as a belated feature in the vein of Canvas Studio. This year Anthology added capabilities for VR video types - I am not sure if this is a significant feature or just for isolated / fringe usage. But it is something to watch.

Anthology Messaging

Last year Anthology cleaned up its message, moving from gosh we have lots of stuff to one centered on three pillar solutions (SIS + CRM + LMS) and a few complementary solutions (e.g., Ally). That message continues but also is starting to address the past problems with services around SIS and how they are addressing this situation and seeing better client retention and completed installations.

The other issue is that finally Anthology is ditching the Learn Original / Learn Ultra distinction and disastrous messaging of the past 7-10 years. Learn Original has an end-of-life of December 2026, and the Blackboard LMS is just that. THE LMS from Anthology.

This move should have been made long ago. Anthology (and Blackboard as a standalone company before the 2021 acquisition) worried that pushing customers to Learn Ultra too strongly would lose more customers, but they lost those customers anyway. It would have been better to bite the bullet and make the product end-of-life and messaging change so that Anthology could focus on one product and the future.

Anthology finally has done this, and I will note that much of the LMS market slowdown (fewer product switches) can largely be attributed to fewer Blackboard customers leaving. At least until this year’s debt problems, which we will get to.

My biggest complaint at the conference was that Anthology put too much emphasis on the combination of products and did not address the fact that these markets (SIS and CRM and LMS) are mostly best-of-breed markets. I get and appreciate how Anthology is trying to address the entire student lifecycle and provide more holistic views of students, and I see some tangible benefits acknowledged by customers, but in reality markets have different priorities and should lead to more emphasis on how each product compares to competitor offerings.

Anthology Debt

In January I wrote about Anthology skipping an interest payment in agreement with its first-lien debt holders, which set the clock ticking on a required resolution.

The problem is that the deal structure was based on 2021 assumptions. Market valuations for software companies were at a peak, interest rates were low (essentially free money), and Covid usage bumps made it seem like Anthology was taking off. Last year, equity and lenders had to step in and recapitalize the company, allowing Anthology to continue investing in AI and other product improvements. This move roughly coincided with a revised executive team.

With the December 2024 debt payment issue, there initially appeared to be an agreement between debt and equity holders, meaning that there might be resolution prior to last week’s users conference. Obviously that didn’t happen, and in April I described that Veritas, the private equity owner of Anthology, appeared to be writing off its full stake in the company.

In May, however, there was a new effort made to break up the company and sell off Blackboard and possibly other assets as a different method of resolving the debt crisis. At the same time, Moody’s emphasized its view of Anthology’s prospects.

The Ca CFR reflects Anthology's high likelihood of a debt restructuring or a default in the near term, despite the changes to the terms and conditions of the loan to temporarily alleviate liquidity pressure.

In that post I noted that new distressed debt holders (companies that specialize in timing the market on buying this debt and then restructuring) were driving the process, and not Veritas.

I didn’t mention it at the time, but the two companies driving this changing process and timeline are Nexus Capital Management and Oaktree Capital Management. Nexus owns most of ACT (which in turn owns Encoura and Eduventures) and Savvas (the spinoff of Pearson’s K-12 business line). Oaktree has held an Anthology position longer and is more passive, while Nexus is more recent and fully behind the recent moves.

Since that May post, the efforts to sell off parts of Anthology have mostly (but not entirely) faded away. There still is a longer shot that some buyer will acquire Blackboard or some major portion of the company, but more likely are the following outcomes.

The most likely outcome is a debt restructuring for the combined Anthology company, with official moves made in September or October.

There still is a chance of an agreement that can be struck out of court, but in my opinion it is more likely that Anthology will have to declare Chapter 11 bankruptcy this fall.

As stated in the previous posts, this would not mean that Anthology ceases to operate; rather, it would mean that the company would continue to operate while they (or the courts) oversee the restructuring of debt and setting up of new owners. See Cengage and 2U and other EdTech vendors for examples of this type of bankruptcy.

All indications are that debt holders would take over all or most ownership and write down the majority (but not all) of the ~$1.5 billion in debt.

This places a premium on how well Anthology can manage the messaging and public relations in the fall to avoid losing more customers simply through fear and risk management. Anthology’s competitors are being very aggressive in their sales outreach, particularly Ellucian and Instructure.

I should note that Anthology executives have been quite open in this process. They were the source for the September / October timeframe, and they confirmed the Nexus and Oaktree information. The conjecture about Chapter 11 vs. out-of-court is mine. Obviously the execs put a positive spin on the process, but the transparency is worth noting.

Putting It Together

In an alternate time frame, Anthology’s significant improvements in product design and messaging wouldn’t be clouded by the debt restructuring and financial challenges. In that world, the LMS market would be healthier and Anthology’s prospects much more aligned with college and university needs.

This is the challenge for Anthology today. It no longer is whether Learn Ultra will replace Original or whether the Blackboard LMS will develop capabilities that allow it to compete more effectively in a best-of-breed market. And the challenge is no longer whether Anthology can stop confusing and alienating customers with broken messaging. Those issues have all been mostly addressed, and we have already seen reduced customer losses.

The challenge, however, is whether and how Anthology can resolve the financial challenges without making those product and messaging improvements moot. There will be a lot to watch this fall in the LMS market.

The main On EdTech newsletter is free to share in part or in whole. All we ask is attribution.

Thanks for being a subscriber.