Fall 2024 IPEDS Data: Profile of US Higher Ed Online Education

Modest year-over-year growth of 2.7% from 2023-24 and continued growth in online modalities

Was this forwarded to you by a friend? Sign up, and get your own copy of the news that matters sent to your inbox every week. Sign up for the On EdTech newsletter. Interested in additional analysis? Upgrade to the On EdTech+ newsletter.

The Fall 2024 IPEDS data provide the clearest picture yet of where U.S. higher education has landed after the pandemic disruption. Enrollment is no longer in free fall, online participation has stabilized at a higher baseline, and recovery remains uneven across sectors. The data point to a new equilibrium, not a return to pre-COVID norms .

Headlines

Total enrollment increased again, but modestly.

U.S. higher education enrollment grew for the second consecutive year, reaching 19.6 million students. This confirms stabilization, but the rebound is far more restrained (2.7% YoY) than early National Student Clearinghouse estimates (4.6% YoY) suggested.

Growth is real, but selective.

The clearest enrollment revival appears in public two-year colleges and private nonprofit four-year institutions, while public four-year institutions remain stable rather than surging and for-profit sectors continue to face structural headwinds.

Community college growth comes with a caveat.

Much of the recent public two-year increase is driven by dual enrollment, which boosts headcount but carries very different economics than traditional adult or degree-seeking enrollment.

Online education remains structurally elevated.

Over half of all students now take at least one online course, well above the pre-pandemic trajectory. Despite widespread dissatisfaction with “Zoom U,” COVID ultimately accelerated and normalized hybrid participation, rather than slowing it.

This is stabilization, not recovery.

Enrollment remains well below 2012 levels, and institutional conditions differ sharply by sector. The data suggest higher education is reassembling itself under new assumptions, not returning to its prior model.

The sections that follow unpack these trends in detail, beginning with total enrollment patterns, then sector-level shifts, and finally the evolving role of distance education across undergraduate and graduate programs.

Data Notes

Please note the following:

There are multiple ways to filter and select data. For this set (as with previous analyses for consistency’s sake), I have limited to U.S. degree-granting institutions in six sectors – public 4-year, private 4-year, for profit 4-year, public 2-year, private 2-year, and for profit 2-year. For undergraduate totals I have included degree-seeking and non-degree-seeking students (degree-granting institutions can offer non-degree programs).

For the most part distance education (DE) and online education terms are interchangeable.

Exclusive DE is for students taking all courses online; Some DE is for students taking some (but not all) courses online; At Least One DE, or ALO DE is a combination of exclusive and some DE. No DE is for students taking all courses face-to-face.

I am using Adjusted Sector to categorize the data, as this removes the numerous sector changes since 2012 where a 2-year institution adds a small number of bachelor’s degrees and is reclassified by IPEDS as a 4-year institution. This despite the predominant degree offering being a 2-year associate’s degree. I believe this gives a more accurate representation of how each type of institution is faring.

Also note that we have covered the 12-month Headcount IPEDS data (which counts all students at an institution over each year, compared to the census method of the Fall data) in this most recent post.

The Headline Numbers - Total and By Sector

First a view of total enrollment trends from 2012 - 2024.

This chart shows a clear but muted rebound in total U.S. higher education enrollment in Fall 2024. After more than a decade of mostly steady decline, punctuated by a sharp pandemic-era drop in 2020, total enrollment rose from 19.13 million in Fall 2023 to 19.65 million in Fall 2024, a 2.7% year-over-year increase. This marks the second consecutive year of growth following the 2020–2022 contraction and confirms that higher ed is no longer in free fall. However, the headline matters as much as the magnitude: while growth is real, it is far more modest than suggested by the National Student Clearinghouse’s CTEE estimates, which paint a more optimistic picture of postsecondary recovery. The IPEDS-based view suggests stabilization and partial recovery, not a return to pre-2019 enrollment levels or a broad-based resurgence.

The year-over-year change line reinforces that interpretation. The +2.7% gain in Fall 2024 follows a +2.6% increase in Fall 2023, after several years of negative or near-zero growth. In historical context, this looks less like a boom and more like a correction from an unusually depressed baseline, especially given that total enrollment in 2024 still remains more than a million students below 2012 levels. The takeaway from the first chart is therefore cautious: the system is growing again, but the recovery is slow, uneven, and fragile, and should not be overstated.

Now let’s look at enrollment trends by Adjusted Sector.

This chart, which disaggregates enrollment by adjusted sector, helps explain where the growth is actually coming from and where it is not. Two sectors stand out in Fall 2024: public two-year institutions and private nonprofit four-year institutions. Public two-year colleges, which had experienced the steepest and longest declines of any sector, posted a notable rebound, growing by nearly 5% year over year. While still well below their pre-pandemic enrollment levels, this marks a meaningful shift after years of contraction and suggests renewed demand for lower-cost, workforce-oriented pathways. At the same time, private nonprofit four-year institutions continued their gradual recovery, posting modest but positive growth after largely treading water for much of the past decade.

One important caution in interpreting the apparent rebound at community colleges is that much of the recent growth is driven by dual enrollment, not traditional adult or postsecondary students returning to campus. While dual enrollment expands headcount and reflects stronger K–12 partnerships, it comes with very different and often more challenging economics, including lower tuition revenue per student and higher coordination costs. As a result, this increase should not be read as a clean signal of organic recovery in core community college demand; it boosts enrollment totals, but it does not necessarily strengthen institutional finances or capacity in the same way as growth among degree-seeking adult learners.

By contrast, the other sectors show more continuity than change. Public four-year institutions saw steady but unspectacular growth, reinforcing their role as the most stable enrollment anchor in the system. For-profit four-year institutions continued their long-term decline despite a small uptick, while for-profit two-year institutions remained volatile and marginal in scale. Overall, the sector-level data point to a recovery that is selective rather than universal, driven primarily by renewed strength at community colleges and incremental gains among private nonprofits. Taken together, the two charts underscore a key theme for Fall 2024: enrollment is finally growing again, but the recovery is narrower, slower, and less transformative than some headline narratives suggest.

Profile by Modality (Exclusive DE, Some DE, No DE)

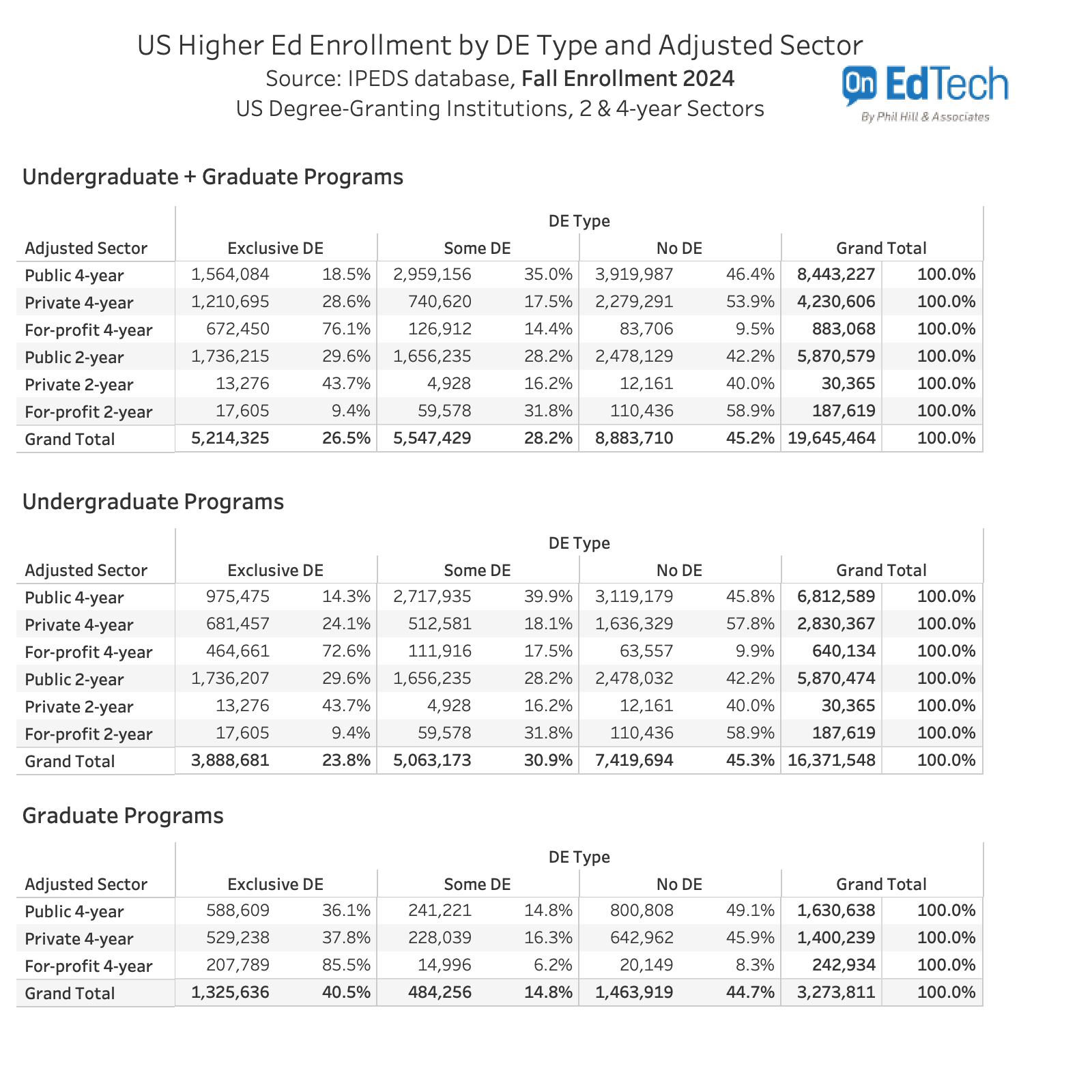

Below is a profile of online education in the US for degree-granting colleges and university, broken out by adjusted sector for Fall 2024.

The Fall 2024 IPEDS data show that distance education participation continues to edge upward, but the story is one of incremental change rather than a structural shift. Across all undergraduate and graduate programs combined, total enrollment increased from about 19.1 million in Fall 2023 to 19.6 million in Fall 2024. Within that growth, enrollments in exclusive distance education programs rose from 26.4% to 26.5% of all students, while some distance education also ticked up slightly (from 27.9% to 28.2%). Correspondingly, the share of students with no distance education declined marginally, from 45.7% to 45.2%. In other words, online learning’s footprint expanded again, but by fractions of a percentage point rather than leaps.

Looking by level and sector, the familiar patterns from 2023 largely held in 2024, with modest intensification in a few areas. Graduate education remains the most online-oriented, with exclusive distance education rising from 39.4% to 40.5% of graduate enrollments, driven especially by for-profit four-year institutions, where more than 85% of graduate students are fully online. Undergraduate programs showed smaller movement: exclusive distance education grew from 23.7% to 23.8%, while “some DE” nudged upward and “no DE” slipped slightly. Public two-year institutions remain the largest single contributors to online headcount, while private nonprofit four-year institutions continue to enroll a majority of undergraduates with no distance education. Overall, the Fall 2024 data reinforce the post-pandemic equilibrium seen in Fall 2023: online education is still growing, but primarily through gradual normalization and selective expansion, not wholesale migration.

Nonlinear Trends

To get a sense of the growth in the number of students taking at least one online course (which combines those in fully-online programs with those mixing face-to-face and online courses), this pincer chart (as Morgan calls it) displays the trend along with an extrapolation of the pre-pandemic trends (in black).

Viewed over the long arc from 2012 to 2024, the share of U.S. higher education students taking at least one online course (ALO) followed a steady, predictable path before the pandemic, and then diverged sharply in ways that surprised many observers. From 2012 through 2019, ALO participation increased gradually from about 26% to 37% of total enrollment, closely tracking the pre-pandemic trend line in the chart. Over the same period, the share of students taking no online courses declined from roughly 74% to 63%, reflecting slow but consistent normalization of online learning rather than disruption.

COVID-19 dramatically altered that trajectory. In 2020, ALO participation spiked to 74%, while students taking no online courses fell to 26%, an unprecedented and clearly artificial peak driven by emergency remote instruction. At the time, many expected the widely criticized “Zoom U” experience to create backlash and slow long-term online adoption. Instead, the opposite occurred. As enrollments settled in 2022–2024, the system did not return to its pre-COVID path. In Fall 2024, 54.8% of students took at least one online course, well above the mid-40% level implied by the pre-pandemic trend line, while 45.2% took no online courses, several points below trend. The lasting impact of COVID was not the temporary surge itself, but a permanent upward shift in the baseline: the pandemic accelerated online adoption and normalized hybrid participation across U.S. higher education, even after emergency conditions ended.

Additional Analysis

If you’ve been considering whether to upgrade to a premium subscription, now may be a good time. I plan to post additional data views in future On EdTech+ posts.

The main On EdTech newsletter is free to share in part or in whole. All we ask is attribution.

Thanks for being a subscriber.