RNL Acquisition of Helix Education: The OPM story

Although last month’s announcement that Ruffalo Noel Levitz (RNL) had acquired Helix Education did not generate much buzz in EdTech circles, I think it is important to understand in terms of the Online Program Management (OPM) and broader Online Program Enablement (OPE) markets. What we’re seeing is likely a new model worth watching to see how the definition of OPMs expands.

From the news release:

RNL, the leading provider of higher education enrollment management, student success, and fundraising solutions, has acquired Helix Education, a firm that has helped numerous institutions maximize enrollment growth through data-driven services and technologies across the post-traditional student lifecycle.

By acquiring Helix, RNL can work with institutions to improve every aspect of the adult student lifecycle—lead generation, lead nurturing, enrollment, academic services, and retention—through an end-to-end marketing, enrollment, and retention technology platform.

Beyond expanding services for RNL, the announcement soon gets to the important market positioning (the acquisition is not just about OPM, but that angle is the most interesting):

The Helix platform amplifies RNL’s already robust capabilities in graduate and online enrollment, while also providing more flexible and transparent options to the traditional online program management (OPM) model. As colleges and universities pivot to online or hybrid delivery of classes and diversify their enrollments by expanding into the adult and graduate student markets, RNL provides the comprehensive support they need to recruit students and deliver a quality educational experience—but with greater control and transparency than what traditional OPMs provide.

Ruffalo Noel Levitz as OPM Alternative

RNL is known for their work in enrollment and marketing, with a wide base of 1,900 clients. Even before the Helix acquisition, RNL had started to market themselves as an alternative OPM provider, a well-worn phrase shared by dozens of companies. We’re and OPM, but trust us, we’re different! All of us. Prominent on RNL’s web presence is the OPM Alternative description.

One area where RNL has little experience has been academic services, particularly curriculum and course instructional design along with academic support. Last April RNL signed an agreement with Kaplan Higher Ed, the OPM provider behind Purdue Global:

RNL and Kaplan are offering two solutions that give institutions the flexibility to provide their students with high level online learning options.

* Universities can access substantial curriculum specifically designed for an online modality from Kaplan. Colleges and universities can format and brand these courses to fit their own programs and adapt them for instruction by their own faculty, allowing students to remain enrolled at the home institution while attending online until they can return to in-person education.

* Colleges and universities can also choose a turn-key solution permitting their students to enroll in courses at Purdue University Global; Purdue Global will deliver instruction and Kaplan will provide non-instructional support to students enrolling with Purdue Global. Institutions may enter into articulation agreements with Purdue Global to recognize credits earned by their students, allowing students to maintain educational continuity and continue progressing toward degree completion.

I have trouble seeing how outsourcing curriculum design to pre-designed courses from Kaplan, or a “turn-key solution” with Purdue Global providing instruction, fits into RNL’s claims for increased transparency and flexibility. I suspect that the Helix acquisition is more meaningful in terms of OPM strategy.

Helix Education Background

Why did RNL acquire Helix Education? It helps to understand a somewhat confusing story of how three different companies came together in 2013.

Datamark was founded in the late 1980s as an enrollment marketing firm, providing market research, lead generation, and conversion marketing for colleges and universities. In 2003, the company was acquired by eCollege.

eCollege was founded in the mid 1990s and became known as the LMS of choice for for-profit and online universities, providing OPM-like services around the core LMS. When Pearson acquired eCollege in 2007 and expanded the OPM services around this organization, they did not want the Datamark portion, and that group was spun off to again become a standalone enrollment marketing firm. Pearson then acquired EmbanetCompass in 2012 and over the years shifted most of their OPM work to that group and away from the eCollege group.

Altius Education was created in the 2000s and was behind Ivy Bridge College, a competency-based school owned by Tiffin University. This deal was unwound in 2012 due to the accrediting agency HLC’s unexpected ruling that I covered at e-Literate. Altius then worked to find a business model based on its Helix LMS designed for CBE (I reviewed this platform in 2014).

These three companies came together in late 2013, as described by founder and CEO Tom Dearden:

Last week marked quite a major milestone in Datamark’s 26 year history serving the higher education market. We announced the acquisition of the technology assets and support infrastructure of Altius.

While we didn’t purchase the entire company, we did buy its impressive technology, intellectual property and infrastructure. This includes Helix, a competency-based online learning platform, as well as enrollment management and retention platforms. [snip]

With this acquisition also comes a change in management. I’m happy that Matthew Schnittman, who I worked with extensively when he led eCollege’s eLearning Division, is joining Datamark as president and CEO.

Datamark also changed their name to Helix Education with this combination. The idea was to go deeper in the OPM market with a heavy focus on the underlying platforms. The CBE platform from Altius did not fit well into these plans and was sold to Ellucian in 2015, with Helix focusing more broadly on OPM contracts and their recruiting and retention platform.

While the corporate tales are confusing, it is important to understand Helix Education’s value to RNL – for the underlying platforms and associated software-as-a-service (SaaS) business model on the front end along with long-term experience with academic services on the back end.

The core platforms in question are based on inquiry management, enrollment management, and retention. This lifecycle is brought together in Helix Acuity, a data intelligence platform promising insights into the entire student lifecycle.

RNL’s New Model for OPM

RNL can now offer a combined offering in the OPM market that actually is an alternative model. Most of the fee-for-service models and broader Online Program Enablement (OPE, but often described as OPX) expansions of OPM focus on the lack of long-term, full-service product bundles. Schools using OPE are told that they do not have to do a revenue sharing agreement and are free to leave if the partnership does not work out. But what happens with the existing online program at a school – do they have to start from scratch and develop their own marketing and enrollment solutions, or worse yet have to fit into the traditional marketing groups at the host university?

With Helix, RNL has a SaaS business model that allows the company to say to a school who no longer wants OPM service that they are not on their own, RNL can offer them a software solution to continue working wit the same platform and the same set of leads that have already been built up over time. Add that to RNL’s existing broad services (i.e. beyond online programs for a large number of schools) and very strong position for enrollment marketing, and we seem to have a new model entering the OPM market.

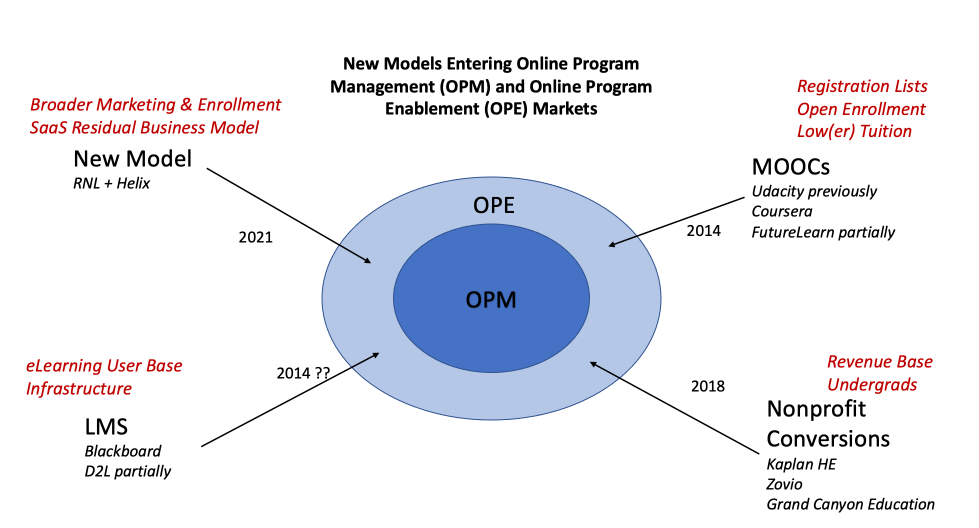

Of course, this is not the first time that we’ve seen a new business model from existing EdTech companies migrating to serve the OPM / OPE markets.

LMS – Blackboard supported the University of California’s attempt at systemwide online programs, UC Online, in the early 2010s. Blackboard has long had more to offer than the core LMS, including call centers and consulting services. While this LMS as OPM model has not gained much traction, Blackboard last year began marketing themselves as an OPM alternative, or an OPX. LMS models bring a wide user base and infrastructure based on existing customers.

MOOCs – In 2014 Udacity jointly developed an online master’s of computer science with Georgia Tech, leading to enrollments of more than 8,000 students by 2019. Udacity was dropped last year, however, as their business model has changed. Coursera has had more success with OPM support for programs like the University of Illinois Online MBA (iMBA). The MOOC model’s promise is based on having tens of millions of potential students in their registration lists, theoretically minimizing the amount of marketing spend needed. In addition, MOOC models offer open enrollment options to find interested students. The combination of these two attributes have initially been used to help develop lower-cost online programs.

Nonprofit Conversions – There have been several for-profit universities with tens of thousands of online students, most of them in undergraduate programs, that have spun off the school into a nonprofit entity, while the remaining for-profit company becomes an OPM provider. Think Kaplan Higher Ed and Purdue Global, Zovio and University of Arizona Global, and Grand Canyon Education and, well, Grand Canyon University (but also with new clients based on their acquisition of Orbis Education). This model brings very large revenue base of hundreds of millions of dollars into a market that favors scale and financial resources. It also brings in extensive experience serving online undergraduate students, a market that has been lightly served by traditional OPMs.

In all of these cases we have companies that already have scale in some other adjacent market, and each with its own unique attributes. While it’s too early to determine how much success RNL will have with the new acquisition, I do think this is an important story to watch in terms of understanding the evolution and expansion of OPM markets.

Update 2/17: Corrected the reference to GCE acquisition of Orbis, not Bisk. That’s the second time I’ve done that – not sure why.

The post RNL Acquisition of Helix Education: The OPM story appeared first on Phil Hill & Associates.