Anthology Declares Bankruptcy, Blackboard to Remain as the Core

The official Chapter 11 plan is to recapitalize around Blackboard and sell off SIS/ERP and CRM/Student Success to competitors

Was this forwarded to you by a friend? Sign up, and get your own copy of the news that matters sent to your inbox every week. Sign up for the On EdTech newsletter. Interested in additional analysis? Try with our 30-day free trial and Upgrade to the On EdTech+ newsletter.

Updated 30 Sep 2025: Added the description of Critical Vendors and fixed the reference regarding likelihood of them getting paid.

Late yesterday Anthology (owner of Blackboard LMS as well as SIS and CRM assets) announced its plans to resolve its debt crisis. Chapter 11 bankruptcy plus selling non Teach & Learning assets to competitors. Per Bloomberg:

Anthology Inc., the Veritas Capital-backed education-software provider has sought Chapter 11 bankruptcy protection in the US after a failed attempt to sell the company or parts of the business outside of court protection.

The company filed for Chapter 11 in the United States Bankruptcy Court for the Southern District of Texas, according to a statement on Tuesday. It listed assets and liabilities of $1 billion to $10 billion each in its petition, court documents show.

As part of the process, the firm will focus on its core teaching and learning business, which will be recapitalized with at least $50 million of new cash and its debt completely written off, Anthology said in a press release. The deal is backed by investors that include Oaktree Capital Management LP and Nexus Capital Management, and expected to be completed by early 2026.

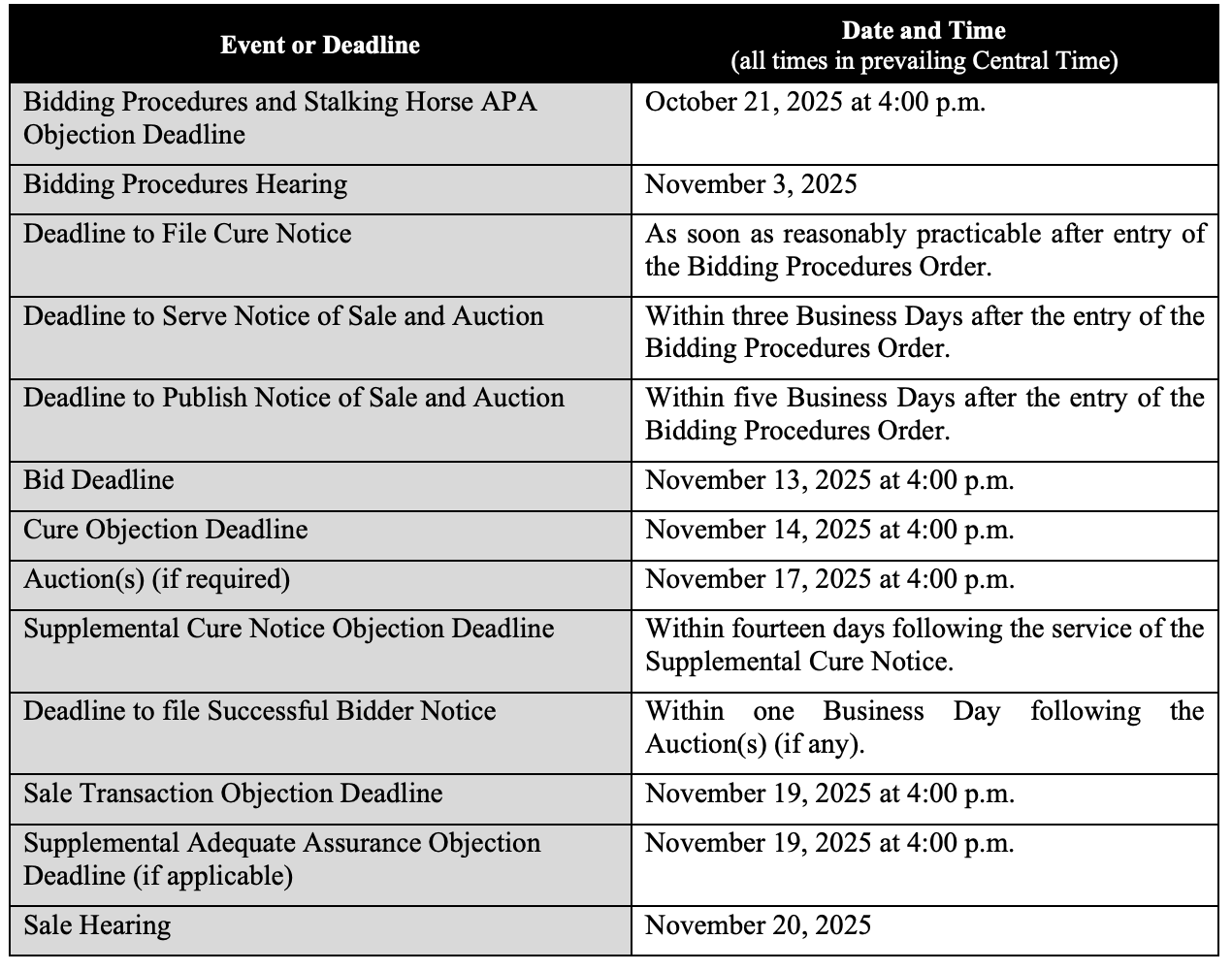

Anthology will sell its enterprise operations, lifecycle engagement, and student success businesses, it said. If enough bids come in by mid-November, the company plans to hold an auction, pick a winner and close any sale by December, according to court documents.

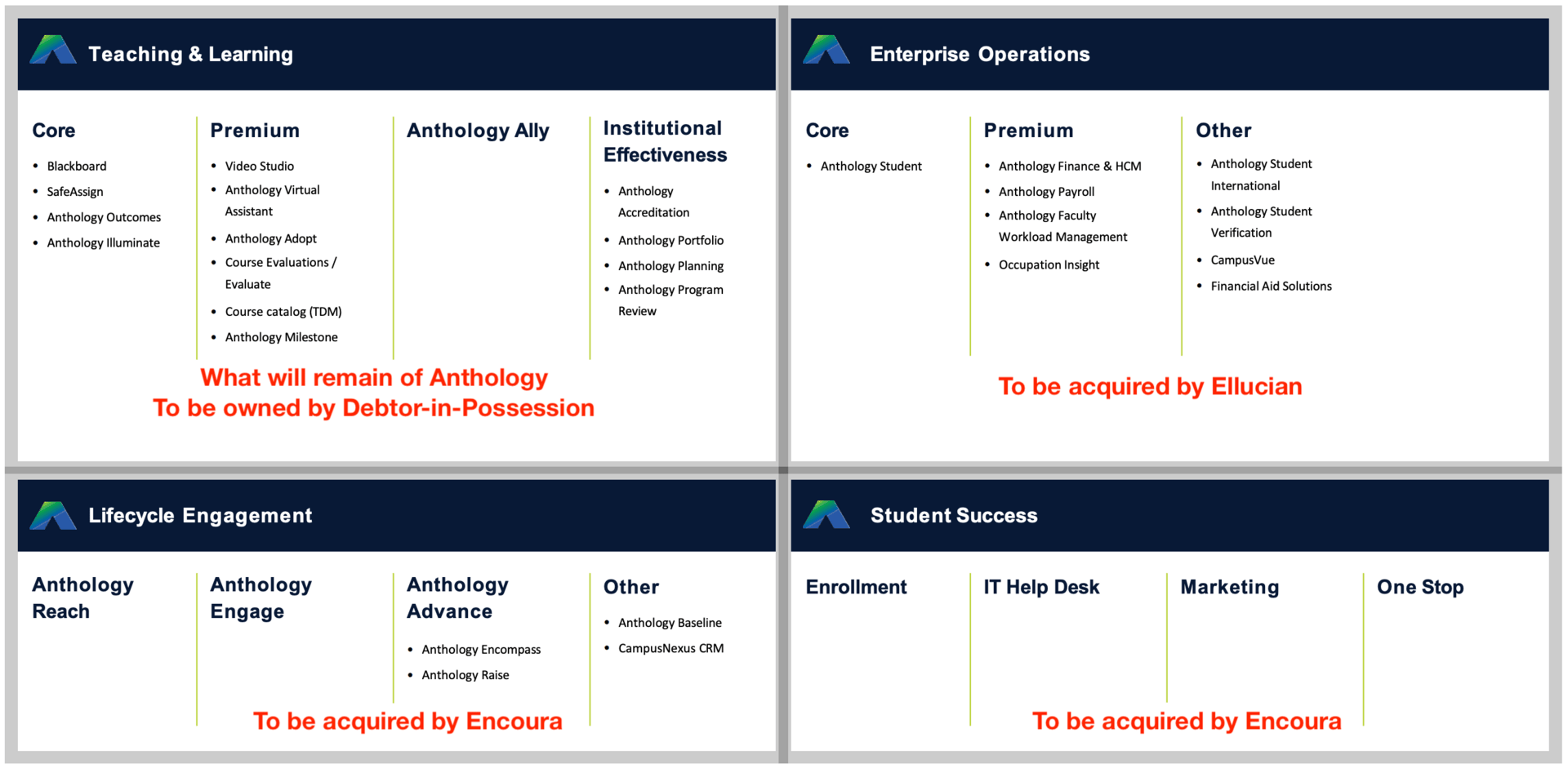

To summarize at the product level, marking up Anthology’s microsite product page with my notes in red, this is the plan entering bankruptcy and the most likely outcome by the end of the year. Anthology remains core LMS and teaching & learning; Ellucian buys the SIS & other ERP elements; Encoura (previously acquired Eduventures) buys the Lifecycle Engagement products (including the CRM) and the Student Success services.

This news brings clarity to our ongoing coverage at On EdTech and the premium On EdTech+. And Anthology has provided a fairly thorough and descriptive microsite for those wanting to learn more details about the bankruptcy process.

Anthology’s Chapter 11 Filing: What Just Happened

When we started covering Anthology’s debt pressures back in January, the storyline was framed as whether Anthology could resolve its debt crisis while avoiding bankrupty. There was already informal agreement among the major players on what would happen. Over the past nine months, however, the narrative shifted dramatically, from controlled restructuring to bankruptcy and breakup, and from leadership decisions to creditor control.

The Role of Nexus and Oaktree

The key turn: distressed-debt investors Nexus and Oaktree bought heavily into Anthology’s loans and effectively took over the process. From that point forward, this was no longer about whether Anthology could refinance or sell on favorable terms; it was about how those new creditors would maximize recovery.

As a reminder, from Anthology [emphasis original]:

To facilitate the reorganization and the sale transactions, Anthology has filed voluntary protection under Chapter 11 of the U.S. Bankruptcy Code. Anthology will operate as usual throughout this process.

If the bankruptcy process goes as planned, Anthology will emerge with a clean balance sheet (no long term debt).

How We Got Here

January–March: Anthology messaging was upbeat. On EdTech coverage from January noted the growing tension between optimistic PR and the reality of debt service and that there was already an agreement for debtors to take possession, albeit by doing this out of court (no formal bankruptcy).

April–September: The company formally shopped its assets, and On EdTech coverage from April noted that PE owner Veritas was essentially walking away, not seeking any ownership as part of the restructuring. In our May coverage, I noted that distressed debt investors were entering the picture and an out-of-court deal was unlikely. In July I named Nexus and Oaktree. Potential buyers, including direct competitors, reviewed the books. No prepetition deal that would have avoided bankruptcy materialized, but the process did lead to the two stalking-horse bids from Ellucian and Encoura.

Summer: As I described in several posts and podcasts / interviews, there has been an increase in university LMS evaluations that are impacted by Anthology’s finances.

Fall: Reports of a break-up became unavoidable. By this point, Nexus and Oaktree were effectively steering outcomes as controlling creditors.

What I Got Wrong

The main issue that I got wrong was in seeing the issue as an either sell off major assets or declare bankruptcy of the whole company.

The most likely outcome is a debt restructuring for the combined Anthology company, with official moves made in September or October.

The actual plan is a both / and situation, selling off major parts to Ellucian and Encoura and also declaring bankruptcy for the remaining Blackboard core.

How Chapter 11 Typically Works

For readers less familiar with bankruptcy, Anthology’s path is a fairly standard corporate Chapter 11 playbook. The company filed “voluntary petitions” that allow it to keep operating while it restructures under court oversight. The court immediately takes up “first-day motions” covering cash management, financing, and, in Anthology’s case, proposed sale procedures. Stalking-horse agreements, like those signed with Ellucian and Encoura, set a baseline price and structure for assets while leaving the door open for others to bid, as described in Anthology’s FAQ document.

A “stalking horse” bid is the offer selected by Anthology as the baseline bid for certain of the Company’s assets. Stalking horse bids are subject to higher and better offers in a courtsupervised auction and sale process. If other companies are interested in one or multiple of our business units, we will hold an auction, which is a day of bidding and negotiations. Auctions typically occur once all bids from interested parties are collected, and can be organized by business unit, defined perimeter, or at different times. At the end of the auction, the highest or otherwise best bid(s) will be chosen to be reviewed by the bankruptcy court after which it will be subject to regulatory approval and customary closing conditions.

It is common in these cases for other bidders to test the waters, and sometimes to top the initial stalking-horse bids. Auctions are designed precisely to maximize value for creditors. That said, Anthology’s assets have already been heavily marketed since April, and most of the likely buyers have already had a close look. The odds of a new strategic or private equity entrant showing up at auction are low, but not zero. What’s more realistic is a modest bump above the current bids rather than a wholesale change in who buys what.

From the filings, here is the relevant schedule. Essentially: bids due November 13th, auction held November 17th (if required), finalize the process roughly by early 2026.

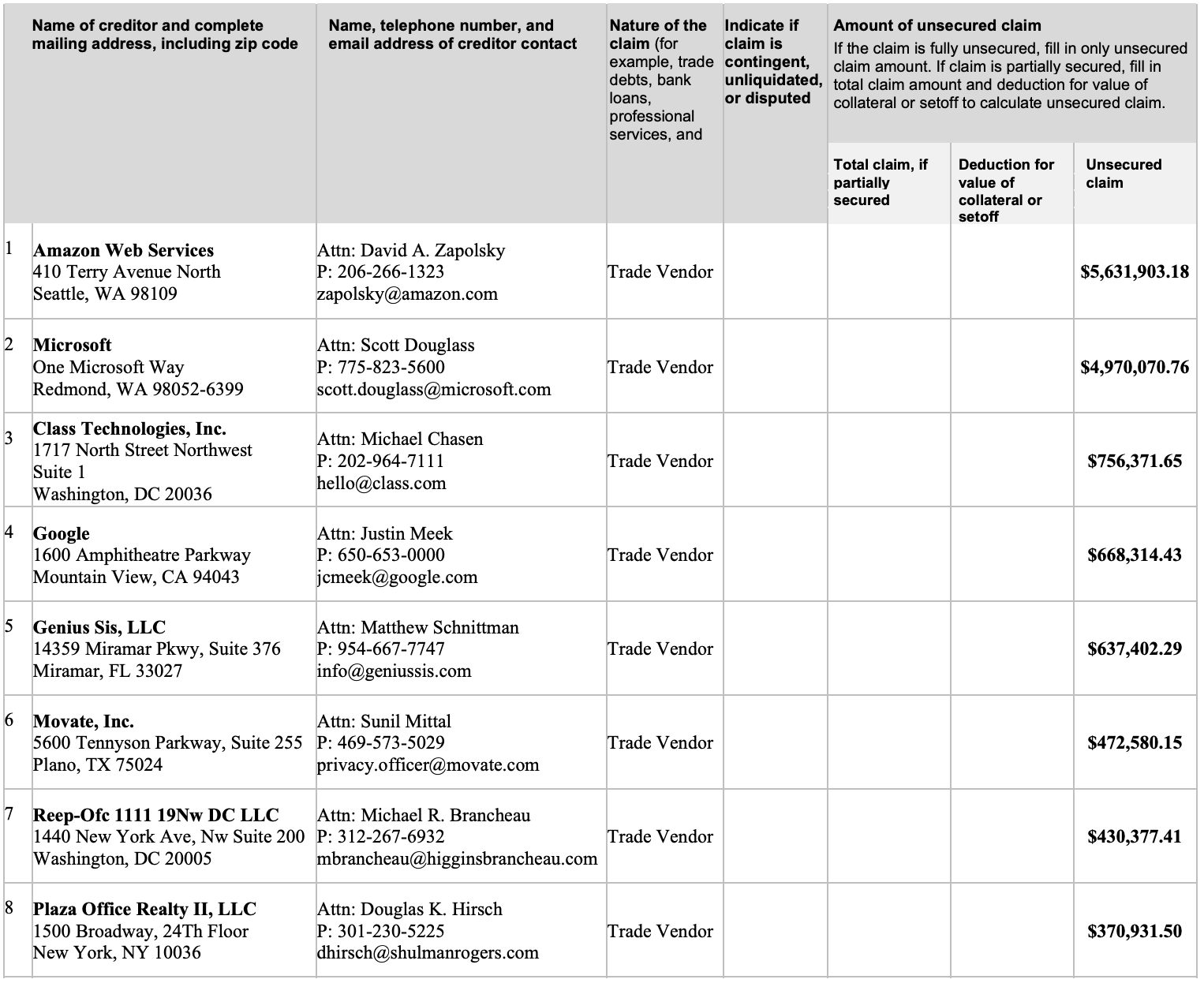

Who are the Unsecured Creditors?

Nexus and Oaktree are the investors driving the process and likely to be the primary owners of the Blackboard / T&L core post-bankruptcy, but it is interesting to look at the unsecured creditors. These are the companies with accounts receivable with Anthology, that will likely only get paid a small portion of what they are owed some of which will only get paid a portion of what is owed. Note, however, that a motion was approved late today to pay a class of Critical Vendors in full. These vendors are not named but are described as follows:

Specialized suppliers of services that are critical to maintaining the Debtors’ day-to-day operations or that are sole or limited source providers of services necessary for the uninterrupted operation of the Debtors’ business.

The unsecured creditors will have some say in determining whether any competing bids are worth accepting through auction in order to maximize their payments. Amazon / AWS is owed $5.6M, Microsoft $5.0M, Class Technologies (Blackboard co-founder Michael Chasen’s company), $756k, and Google $668k.

From the filings:

What This Means for the LMS and EdTech Markets

For campus leaders: Blackboard will continue operating through the case, but the ownership and investment thesis behind the LMS are changing. This could affect long-term product direction and stability.

For EdTech executives: This is a textbook example of distressed-debt control in our sector. It shows how private equity cycles, first driving aggressive expansion, now dictating asset sales, reshape vendor landscapes.

For On EdTech readers: This filing validates what we’ve been tracking all year: the debt story mattered more than the roadmap story, and the real power shifted to creditors months before today’s petitions.

The core question isn’t “Will Blackboard survive bankruptcy?” It will. Rather, it’s what kind of Blackboard emerges when Nexus and Oaktree are in the driver’s seat, and how higher ed institutions adjust to yet another wave of vendor consolidation.

Stay Tuned

There’s a lot more information available in the court filings, but I’ll save that for another post or two. There will be additional coverage at On EdTech+, which is available as an upgrade here.

The main On EdTech newsletter is free to share in part or in whole. All we ask is attribution.

Thanks for being a subscriber.