InstructureCon Conference Notes 2025

Big investments in the platforms but with a growing 'Apple Intelligence of EdTech' risk

Was this forwarded to you by a friend? Sign up, and get your own copy of the news that matters sent to your inbox every week. Sign up for the On EdTech newsletter. Interested in additional analysis? Try with our 30-day free trial and Upgrade to the On EdTech+ newsletter.

In our pre-conference coverage of the LMS users conferences and what to look for, I noted this issue about Instructure.

For Instructure, the dominant theme is coherence—or the lack of it. Canvas remains the market share leader and financially strongest LMS, with significant resources from private equity owner KKR. But the product roadmap has been unclear in recent years, and I am wary of yet another reintroduction of the Khanmigo AI assistant integration. If Instructure wants to stay ahead, it must deliver more than repetition. The company is hinting at meaningful new product announcements, and many will be looking to see if Canvas can recapture the spirit of user-driven innovation—features that actually solve known problems and elicit applause in the room.

Unlike Anthology and D2L conferences, where our pre- and post-conference views remained consistent but with much more clarity, my view post-InstructureCon has significant differences than pre-conference. There is a problem with coherence, but the big change is in the Gen AI vision. Instructure has invested heavily in AI and is making a big bet, but the lack of product delivery creates an ongoing credibility risk that is worth tracking this fall.

KKR Resources

I frequently hear from EdTech execs that their private equity (PE) owners are different, they are about growth and not just profits. I tend to roll my eyes.

But in this case, I am seeing clear differences between KKR’s ownership of Instructure compared to Thoma Bravo’s ownership (including when Instructure was publicly-traded but primarily owned by Bravo). There is a much bigger emphasis on investment in the underlying platforms and in sales. KKR seems to be much more patient and wanting to focus on long-term growth.

I’m sure there are plenty of spreadsheets around in executive meetings, and plenty of financial pressure, but the emphasis seems to be more along the lines of how are you going to be positioned and grow in the 5-year timeframe rather than how can we cut costs today. And KKR has deep pockets.

Canvas Product

AI Updates

The core message at the conference around the Canvas product was on the new AI strategy at Instructure.

IgniteAI was announced as the new architectural approach for Canvas and Mastery usage.

Instructure’s next big leap in secure, in-context AI for education. Powered by AWS Bedrock, IgniteAI simplifies and streamlines the use of AI directly within Canvas and Mastery, enhancing efficiency and driving educational success. This advanced AI solution also seamlessly connects with hundreds of trusted partner tools, saving time and allowing educators to maintain confident control over the learning experience.

Amid explosive growth in AI technologies, educators and administrators face significant challenges in navigating the role of AI in education and effectively implementing a variety of tools. IgniteAI addresses these pain points by delivering confidence, simplicity and substantial educational value, enabling educators and learners to leverage AI intuitively and safely.

The Ignite Agent is the chat-based AI tool to be available throughout Canvas, and it was the key demo at InstructureCon, with references to extensive early adopter testing (more on that later).

It took some digging, since this message was not presented on stage or apparent at the conference, but IgniteAI is a big, meaningful bet.

Instructure views competitors as releasing point solutions - essentially providing specific AI tools within context, such as rubric generation option when an instructor is already looking to create a rubric. Whereas Instructure is going for “an agentic” approach, where the Ignite Agent can take a request at any time, even if an instructor is not in a page to do a specific task. The power (and challenge) is that Instructure is leveraging all of its 500+ APIs so that the agent can know how to take a request. The promise is that this is more intuitive and less demanding for instructors.

Why was this not THE core message at the conference? That is a big claim and a clear differentiator with Anthology, D2L, Moodle, and others. There are portions of this core argument in press releases (this one in particular) and media interviews, but it was surprisingly not clear from the conference programming.

Furthermore, with most of the primary announcements, no dates were mentioned. When will the Ignite Agent be available in production Canvas, for example? I get the desire to not overpromise, but are we talking about Q3 / Q4 / in 2026? Something to help people understand.

Making a lot of headlines was the new integration of OpenAI capabilities directly within Canvas. This will allow instructors to assign, view, and grade AI exercises using ChatGPT tools. The first tool announced, and the one shown on stage, was LLM-enabled assignments where instructors can easily create socratic-method chats where the LLM acts in a specific role.

There are two issues to note, however. One - there was no information on when any of these tools would be available. And two - OpenAI announced ChatGPT Study Tools yesterday where much of this capability is available directly through ChatGPT. The secret sauce of Canvas is the integration, wedging the ChatGPT Study Tools inside the LMS and allowing context to be shared beyond the LLM prompts. But it remains to be seen how unique or meaning that integration is, especially when OpenAI appears to want to own the user experience.

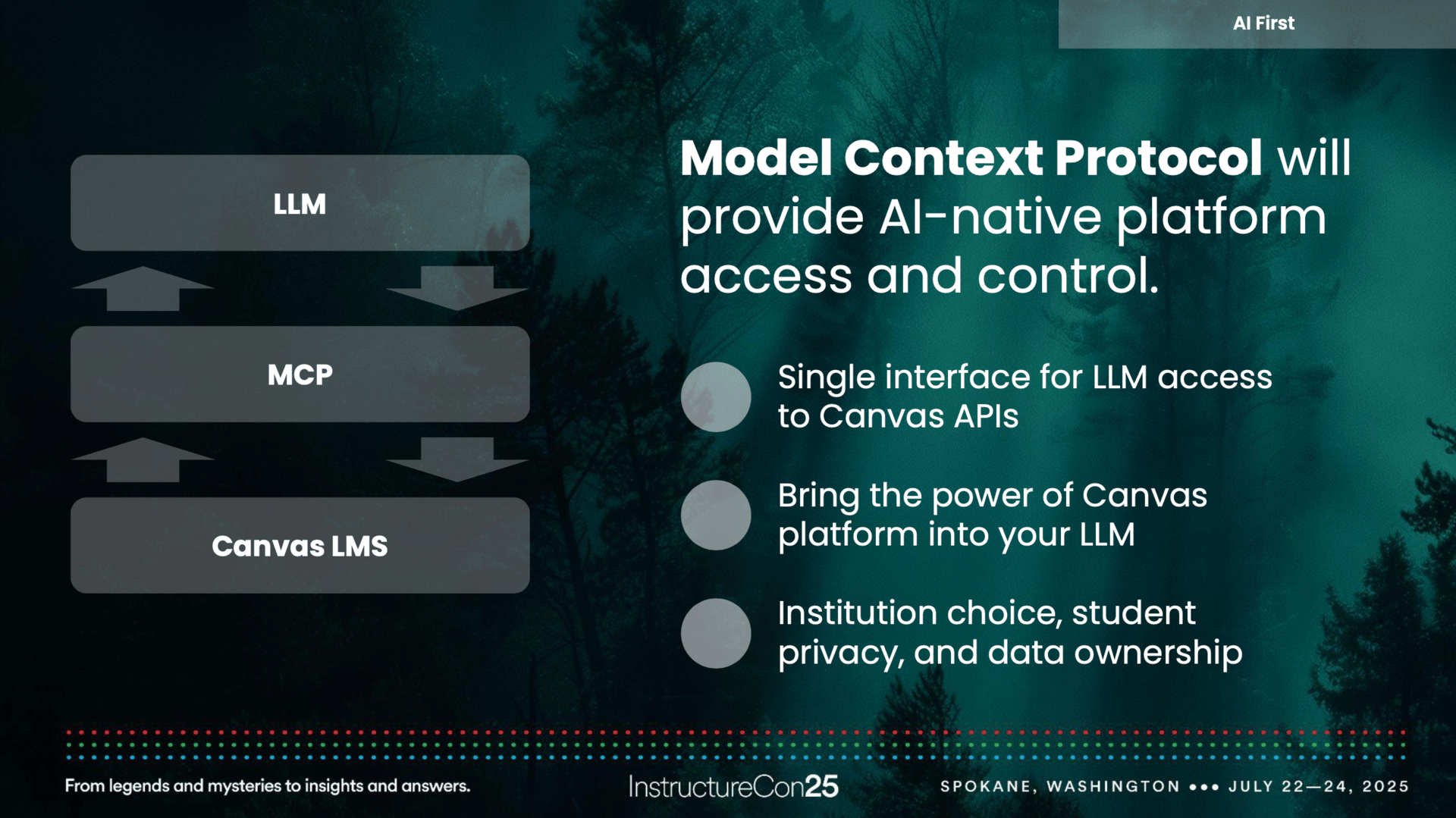

Weaving throughout the AI strategy is an architectural, engineering investment in the platforms. And one of the key areas is the creation of a Model Context Protocol (MCP) layer, and this is a key to understanding the ambitions of Instructure.

MCP refers to a standardized way to structure and transmit contextual information (e.g., user roles, course settings, learning objectives, historical interactions) to AI models that are embedded in a platform like Canvas LMS. This can or should enable the LLM to understand the user role, institutional context, where in the platform the request comes from, and other key context in a layer that abstracts the individual LLM model. And it should help with controlling data based on privacy policies.

Instructure has a bold AI vision with real investment even though they were late to the game. They are not seeking point solutions but rather an architecture with an agentic approach.

But that message was buried at the conference.

Other Updates

I was impressed with the release of Canvas Career, which is a modified version of Canvas leveraging a skills-based focus with AI-first designs (where AI is the primary option, not a side option) meant to support continuing education or government & corporate markets. Initially it is being used in a B2B upskilling sense, helping internal training efforts streamline their efforts.

I asked, and Instructure executives claim that there are plans to leverage the course discovery and e-commerce capabilities of Canvas Catalog to expand the continuing education market for noncredit / microcredentials. That is meaningful, assuming that Catalog can handle the job, and the initial Career demos seem aligned to what these groups need. I can’t find it officially, but I was told that Canvas Career would be in full production by the end of the year.

Morgan and I have been noting how much this market segment for non-matriculated learners represents a real need for colleges and universities but with a fragmented market with no easy solutions.

And that investment in platform seems to be paying off with a clear improvement in accessibility. And a clear roadmap for WCAG 2.1 A/AA compliance.

Coherence In Logos

Last year, there was no clear coherent story on how and why Parchment fits within the Instructure family. Financially, I get it - Parchment is a successful company with real revenue and customer segments (in particular the registrars) that are important but not naturally targets for Canvas. From a marketing and rebranding perspective, there is now a message of the three pillars of the Instructure ecosystem.

But on stage, nothing. Parchment, to my recollection, wasn’t even mentioned in the product keynote. And the Parchment individual sessions were lackluster at best. There seems to be a lot of potential here that is just not yet coming together.

The Big Risk

Like Instructure, Apple redefined a product category starting at the end of the 2000s, and it remains the leader in high-end smartphones and related markets. But there have been concerns that Apple is mostly managing its pre-existing product lines much better rather than still knowing how to innovate and create, at least beyond the introduction of wearables. Still, a great company.

Last summer, however, the company introduced Apple Intelligence after a few years of no obvious AI strategy. The strategy was bold and plays to strengths - AI inference based on custom silicon in iPhones, maximizing privacy in the AI world, user-enabled expansion to private Apple cloud and even public ChatGPT services. The problem, however, was a lack of delivery.

Very few features or products promised last summer have made it to production, and Siri is as bad as ever. The overall Apple Intelligence has shown that the company has something deeply wrong in its product approach, at least within the emerging AI world. Apple executives get defensive and claim some wins in the AI space, but its credibility took a major hit due to this lack of delivery - even if Apple is still financially successful.

That is the risk that Instructure faces. It is not necessarily that it faces the loss of its revenue or market lead, but having an AI story on stage with little to actually show for it in production is not going to work much longer. You don’t want to be the Apple Intelligence of EdTech.

During InstructureCon, there were no timelines mentioned for the big announcements. None of the news is referenced in the public roadmap. There were whispers that the touted early adopter testing of the Ignite Agent saw something quite different than what was presented on stage - from just one month ago.

This raises one of the two big questions for the rest of 2025 in the LMS market (the other being Anthology’s debt restructuring). Is Instructure’s bold AI vision real, or is it half-baked and missing timelines because the company itself does not know what is left to finish products?

This fall and winter will answer the question, based on whether there is real delivery of product capabilities to back up the AI claims. If by the end of the year they release real functionality accepted by customers, then Instructure might leapfrog competitors in the AI race. If they don't, then Instructure will be a company years behind competitors on AI point solutions and with a growing credibility problem.

Even if they deliver working code to back up the claims, however, there is still a risk in whether the market needs or can accept the agentic approach. It’s a big, meaningful bet. This is what we’ll watch.

Parting Thoughts

This is more Morgan’s gig, but I have to share my unofficial conference office. If you find yourself in Spokane, go to Purgatory, even if you’re not Catholic. 1000 bottles of whiskey and some excellent brisket slides (two of the four main food groups).

The main On EdTech newsletter is free to share in part or in whole. All we ask is attribution.

Thanks for being a subscriber.